As climate change raises sea levels and leads to more extreme rainfall events, more homeowners across the United States and the world will have to contend with the threat of flooding. These impacts could well occur within the time horizon of a thirty-year mortgage signed today. To help homebuyers and renters understand the risk of flooding for the homes they are considering purchasing, the Climate Impact Lab supported First Street Foundation to create a risk analysis tool available for nearly every home on major real estate platforms, such as Zillow, Realtor.com, and Redfin.com.

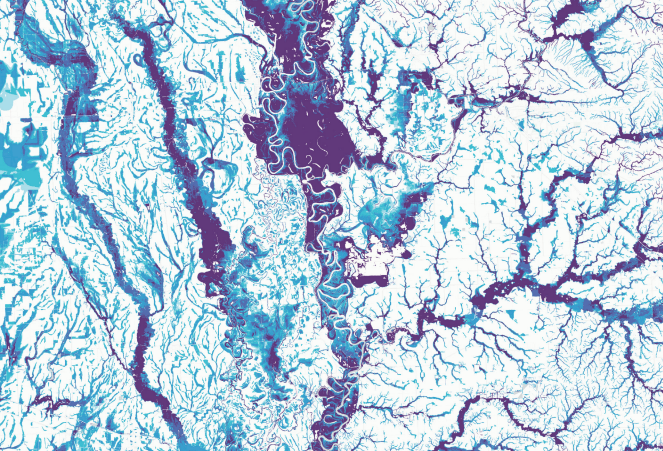

The risk is communicated as a score of one to ten and reflects current and future property-level flood risk. These scores are intended to help with investment decisions for everyone from first-time homebuyers and renters to major property investors. Along with the score on home listings, users can also interact with First Street flood scores through an online visualization. The tool allows users to zoom in to individual towns and even individual properties within that town—an unprecedented level of insight into local flooding risk. A second set of maps on the site projects these risks forward into the coming decades.

Impact

Since the launch of First Street’s flood model, the data has become the de facto standard in academic studies focused on the impact of flood risk on property values and insurance access, and has received press coverage in numerous outlets, including Bloomberg, The New York Times, CNN, Politico, Reuters, and the Wall Street Journal. Their stories call attention to the “hidden” flood risk revealed by the maps that is not evident on flood maps published by the Federal Emergency Management Agency (FEMA), pointing out that homeowners may be liable for unexpected flooding costs. More than twenty local outlets also covered the First Street findings, pointing to climate change as the culprit for increased risk.